Manage refund items

In Vitae, in the following scenarios, refund items are

automatically generated by the system:

• Fee

adjustment after payment and results in excess payment

• MECT

request refund evaluation fee

•

Successful grade review

• Course

cancellation

•

Learner withdrawal

•

Approval of module exemption/credit transfer request

There will also be occasions when the required refund does

not comply with the refund item automatic generation process. Therefore, admin

can also manually create refund items, for example, manually refund the excess

odd-cent amounts.

In Finance > Finance process, click

Refund item in the left navigation, and manage the refunds by the

following approaches.

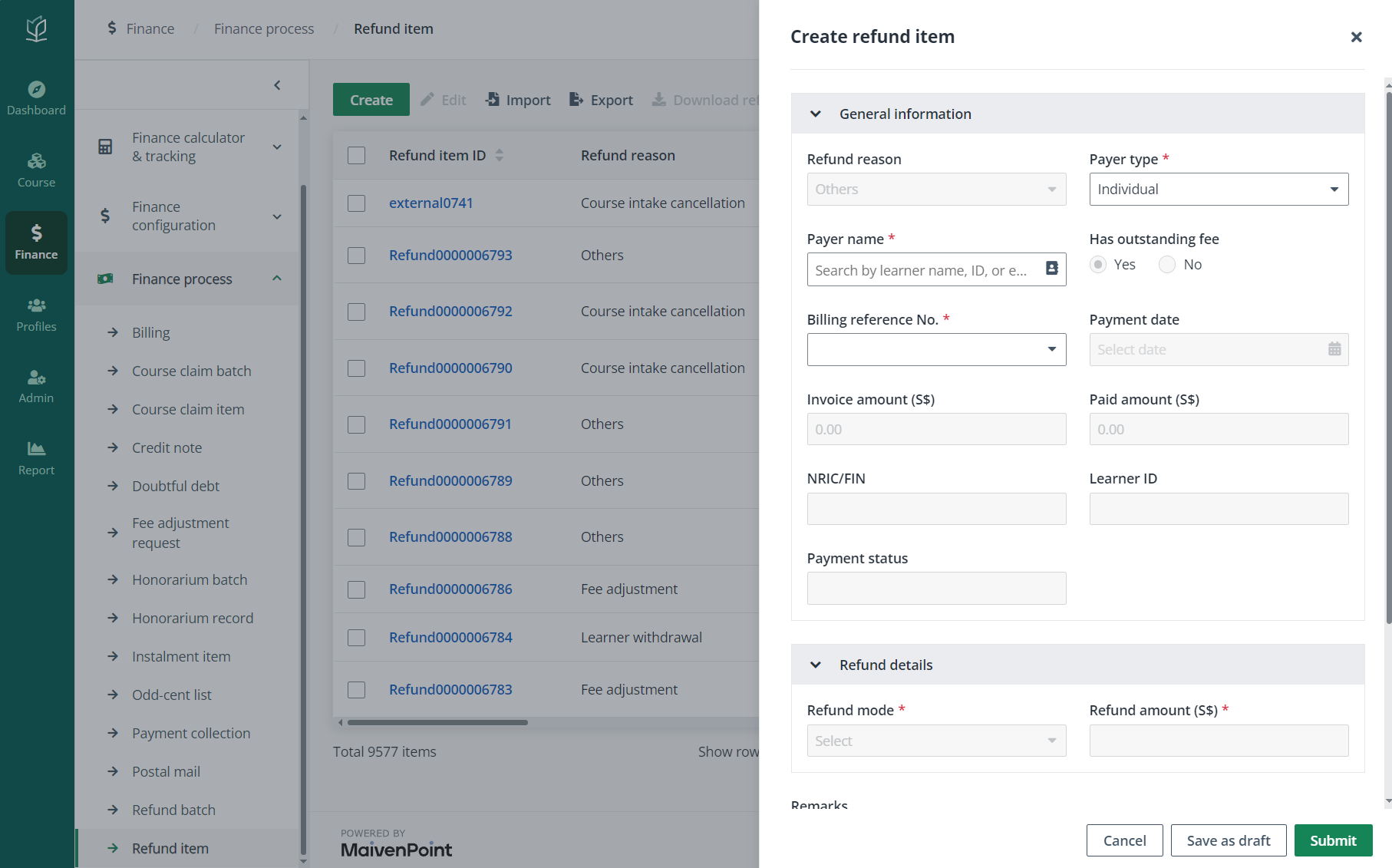

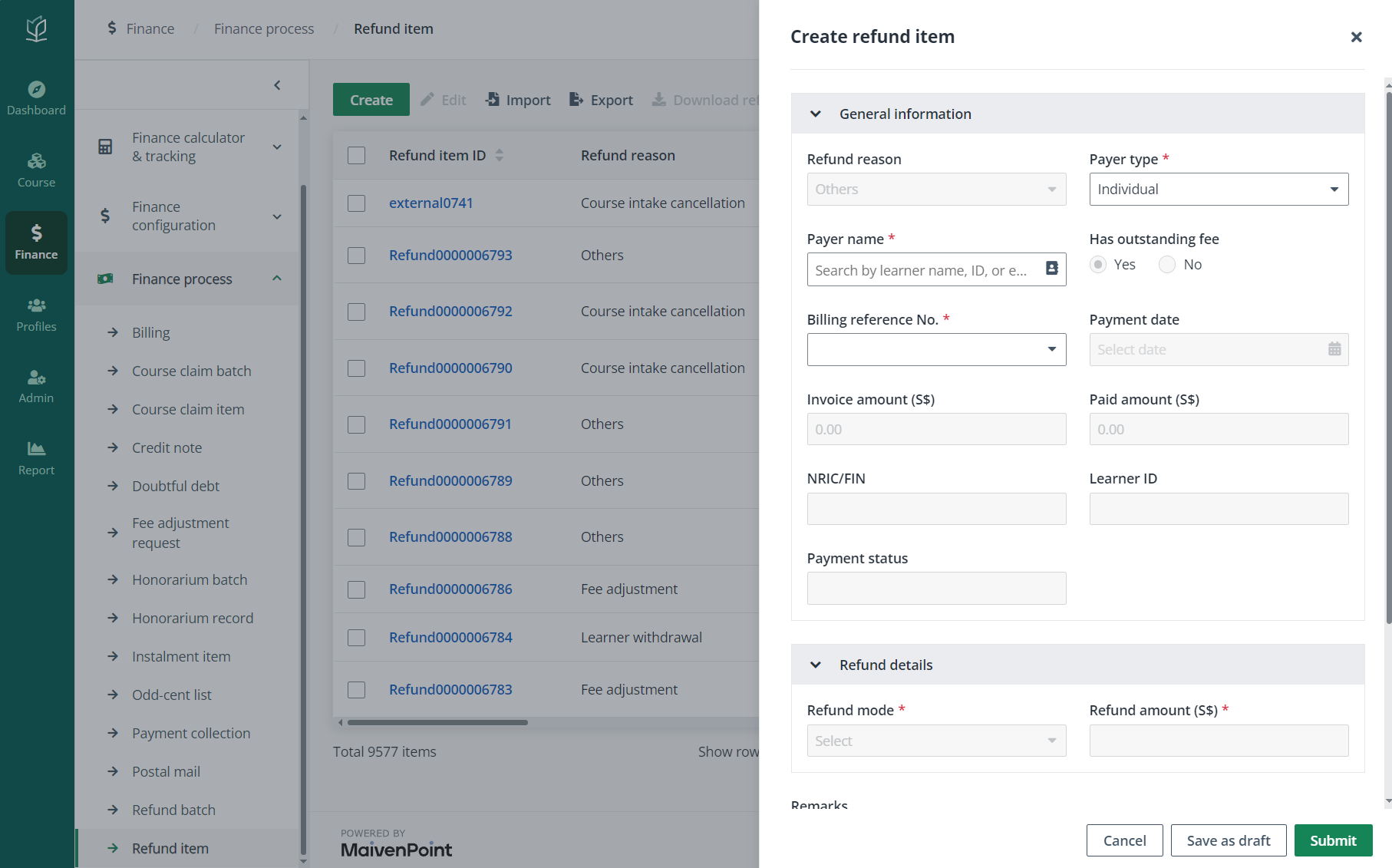

Create a refund item

To create a refund item, complete the following steps:

1.

On the Refund item page, click Create.

2.

In the Create refund item panel, complete the configurations.

3.

Click Submit and click Confirm in the pop-up window. The refund

item will be created and the manual refund request will be submitted.

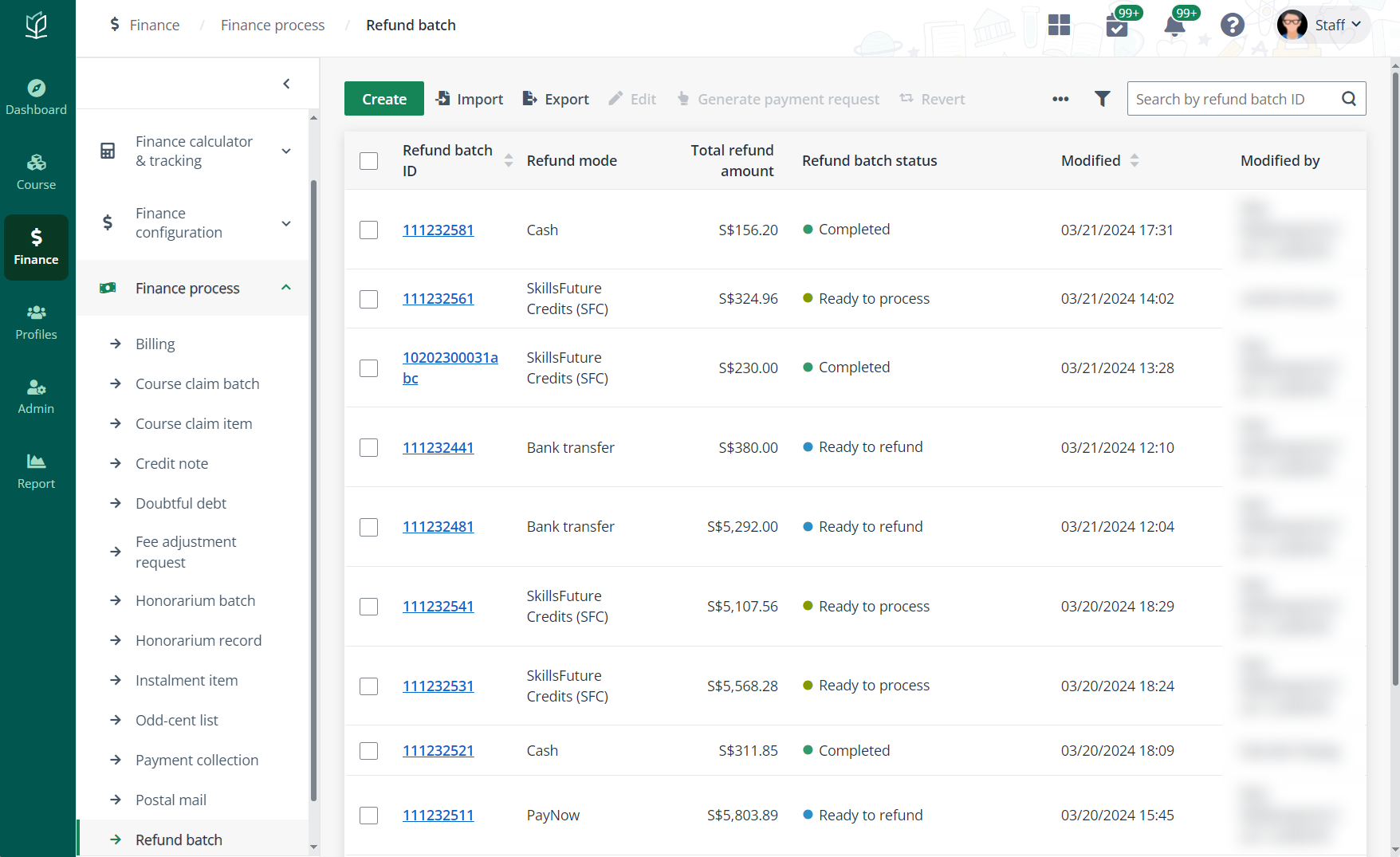

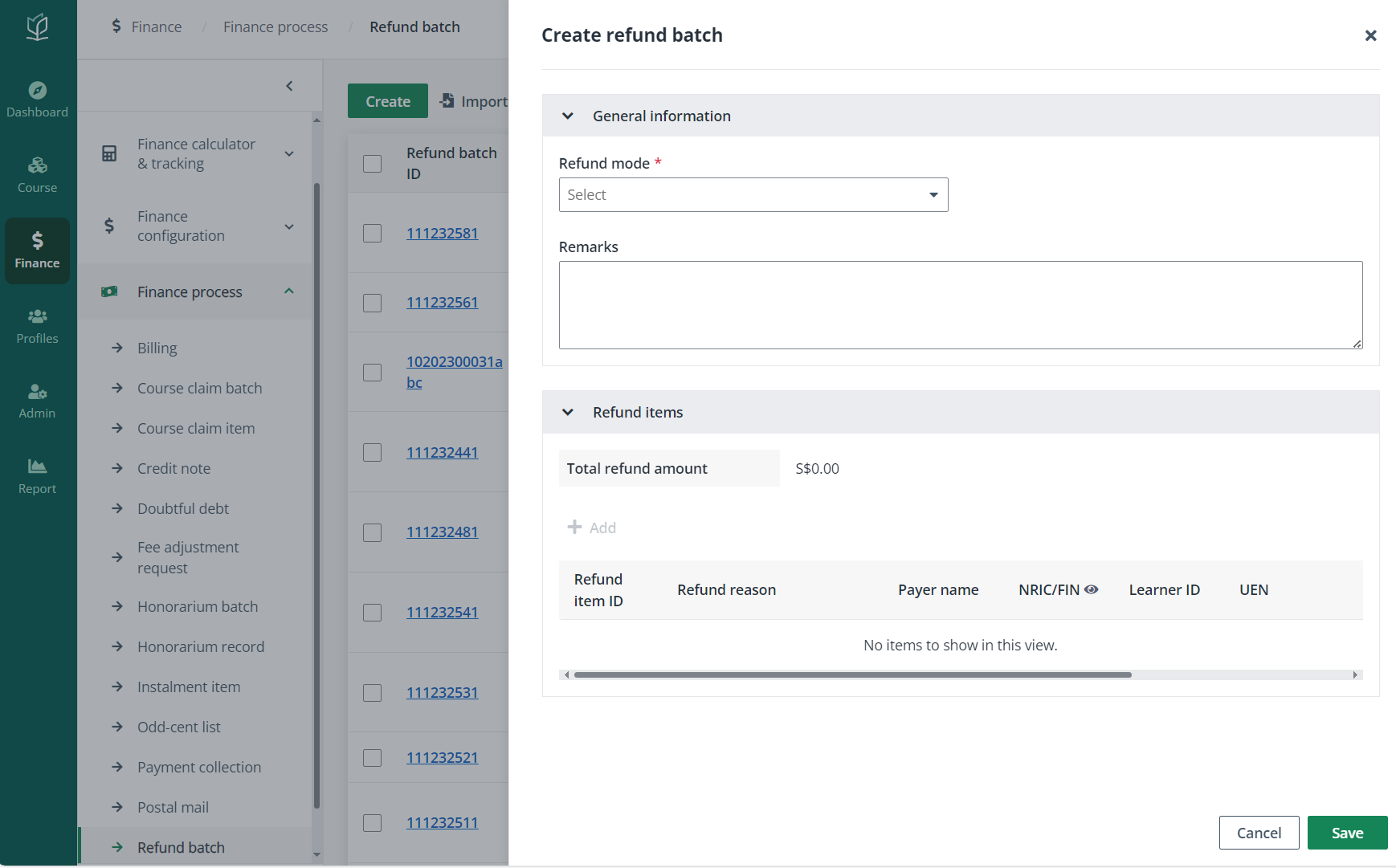

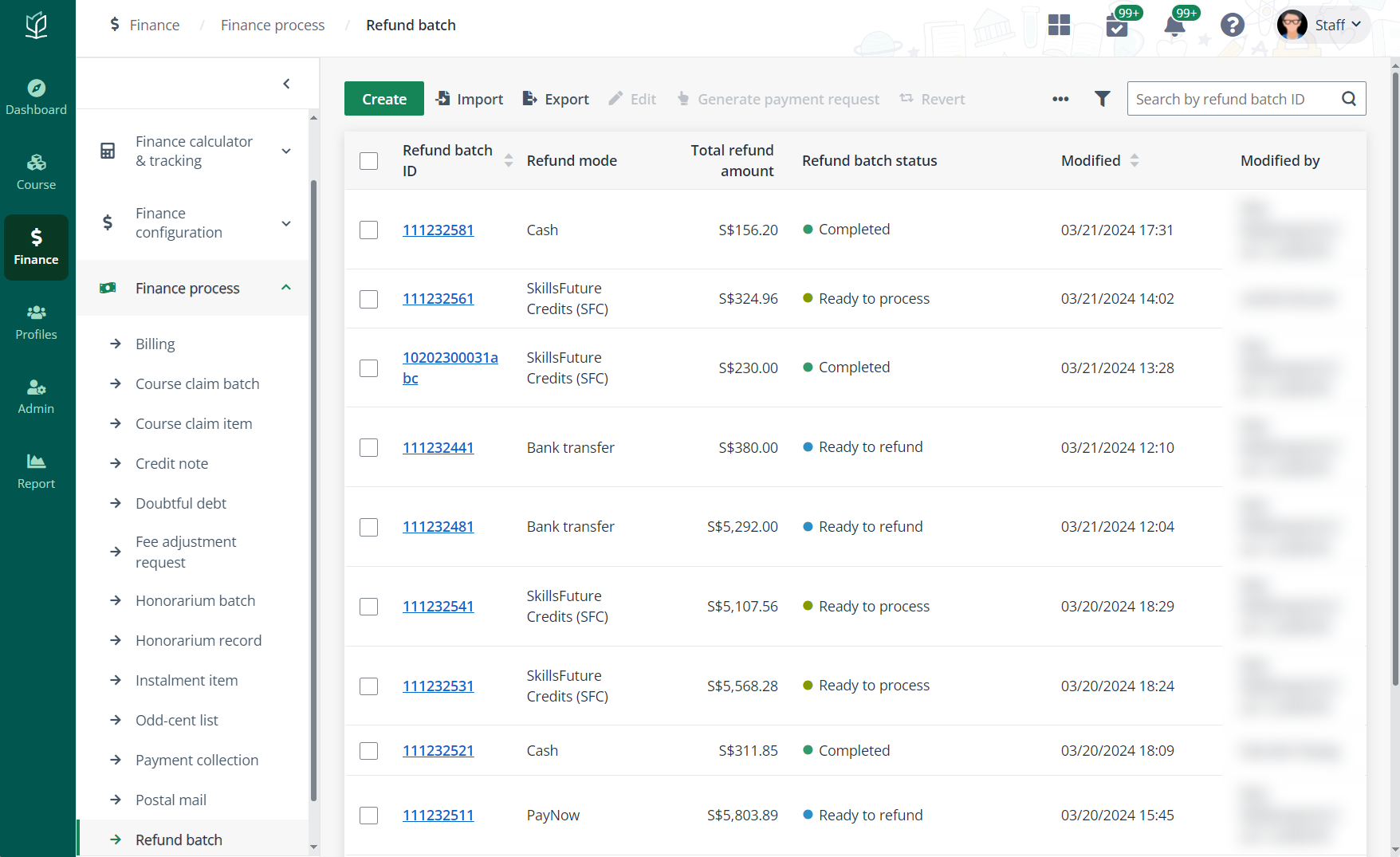

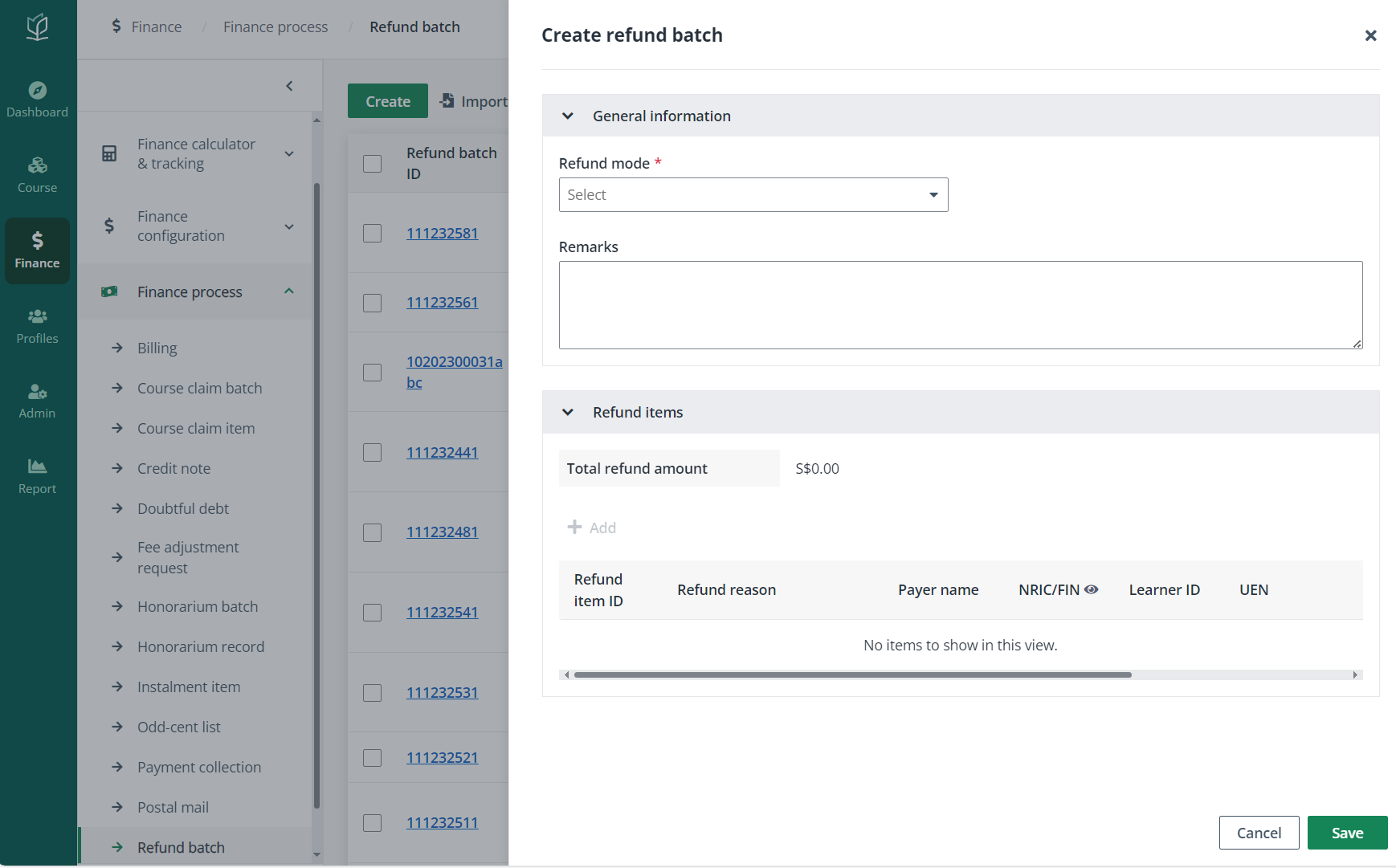

Generate a refund batch from refund item

When there are multiple refund items that are in the Ready

to refund status or refund items whose payment modes SkillsFuture

Credits in the Ready to process status with the same refund mode,

admin can generate a refund batch to process them in bulk.

To generate the refund batch, complete the steps below:

1.

Select the refund items. Ready-to-refund items with the same refund mode can be

found by the Refund item status and Refund mode filters.

2.

Click Generate refund batch.

3.

In the Generate refund batch panel, enter the remarks and add excessive

refund items.

4.

Click Save.

Offset billing from refund

If the refund recipient has outstanding fees to pay, Admin

can offset the unpaid fees from the refund amount.

On the Refund item page, to offset all existing refund

items that can be offset, click Offset all above the table. After

confirmation, the system will perform offset against the bill with the earliest

payment due date within each available item, and against subsequent bills with

the remaining refund amount.

To offset billing from a specific refund item, follow the

steps below:

1.

Select the refund item to offset. The refund item with outstanding fee and are

ready to refund can be found with the Refund item status and Has

outstanding fee filters.

2.

Click Offset.

3.

In the Offset panel, select the billings to offset the refund from.

4.

Click Confirm.

Manage refund expiry

For the accounting management process and refund status

tracking, admin can enable the refund expiry setting to process the refund items

that are expiring to avoid unprocessed items from piling up. To enable the

refund expiry setting, admin needs to go to Admin > Service

management > Finance services. For more details, refer to How to configure finance services?

After a refund item is expired, the status of the refund item

will be Refund expired. According to the service configuration, the refund item

expiry may be approved automatically by system or manually by the specified

approver. Once approved, the status of the refund item will be Refund written

back to mark the temporary written back of the refund item and the refund

amount.

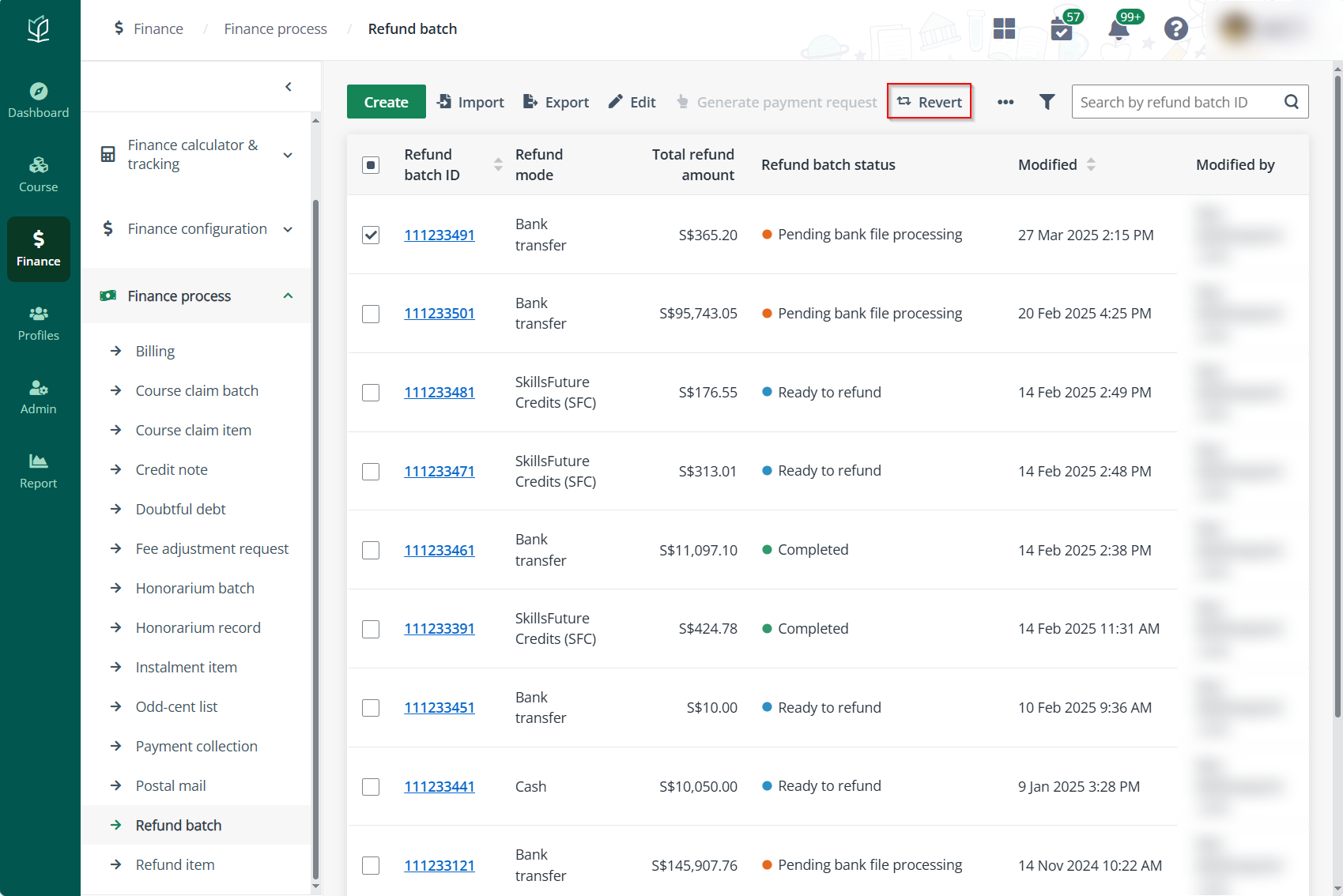

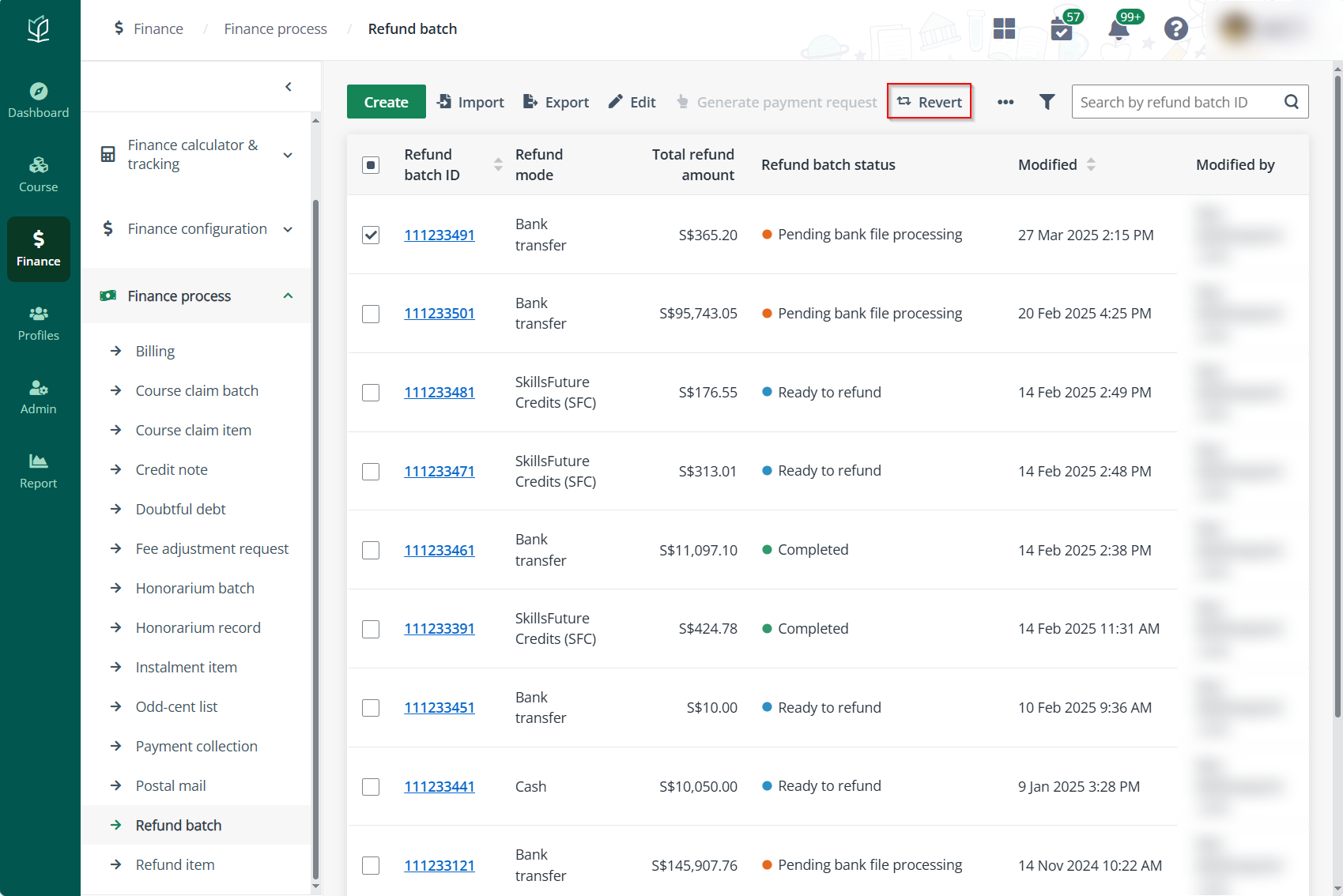

When the written back refund item is requested to be refunded

again, admin can edit the refund item status according to the actual refund

process by following the steps below:

1. Select the target

refund item in the Refund written back status. The written back refund

items can be found with the Refund item status filter.

2. Click the refund

item ID to view the refund item details.

3. In the Refund

item details panel, click Reversal in the bottom right.

4. After

confirmation, the refund item will be reversed and be in the Ready to

refund status.